Business Start Up

Integrity 1st Tax is experienced in helping you start your business, we can help with incorporating, registering your company with the state and getting your Federal tax ID

Hire the pros

Business Start Up

We understand entrepreneurs and the challenges they face when building a company. Our team at Integrity 1st Tax have decades of startup expertise, and can provide a cost-effective, practical solution for your business.

You only have so many hours in the day. Shouldn’t that time be spent focusing on your core business rather than dealing with the administrative headaches of day-to-day accounting? Our outsourced accounting services are a turnkey solution.

Save time, money, and stress.

Business Starting Up

Integrity 1st Tax will be there from the beginning to the end. Integrity 1st Tax has helped business owners successfully navigate the common legal challenges of starting and running a business, we offer legal help that gets your business where you’re wanting it to go quickly, easily, and more affordably.

• Consultation with an experienced accountant

• Business name check

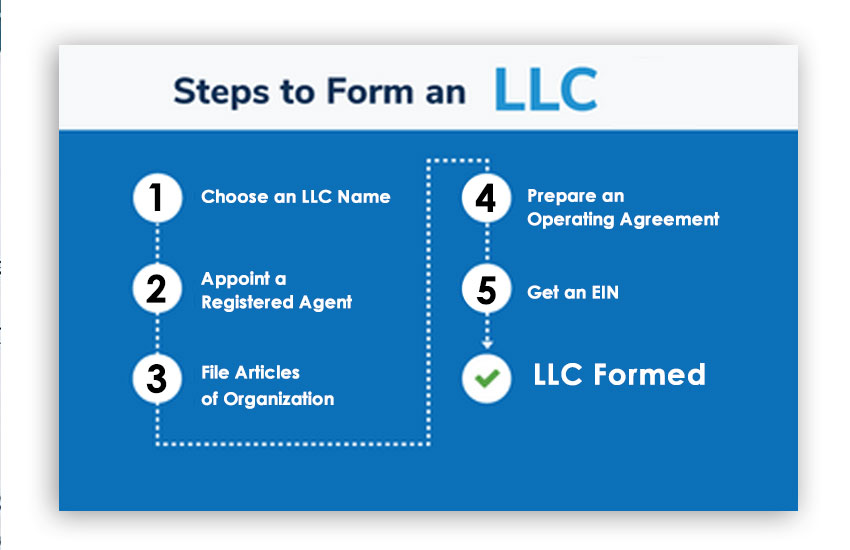

• Articles of Organization or Incorporation with the state of Minnesota

• Secure your Federal Tax ID (EIN)

• Paperwork filed on your behalf

Wrestling with forms

Business Start Up

Many “start a business services” offer confusing online forms that ask hard questions and then spit out a generic document that you have to file yourself. These automated services leave people confused and frustrated.

Step one is to familiarize yourself with the most common types of business structures.

Sole Proprietorship: If you start conducting business and don’t file for another entity type, you’re considered a sole proprietor. Sole proprietorships offer virtually no legal liability protection.

Limited Liability Company (LLC): An LLC protects your personal assets from business debt, offers simplicity in management and flexibility in taxation. They are a great choice for many businesses.

C Corporation: C Corps offer the strongest protection from personal liability but are more complex to set up and manage. Also, C Corps are subject to double taxation in certain situations.

S Corporation: S Corps combine the formality and protection of C Corps with the flexibility and pass through taxation of LLCs, which allows you to avoid the double taxation of C Corps.

Entity selection requires you to consider critical tax and legal factors that will impact your business over the long-term. Integrity 1st Tax begins with a business questionnaire and a consultation.