Serving Minneapolis & St Paul

Minnesota Tax Services for Small Businesses & Individuals

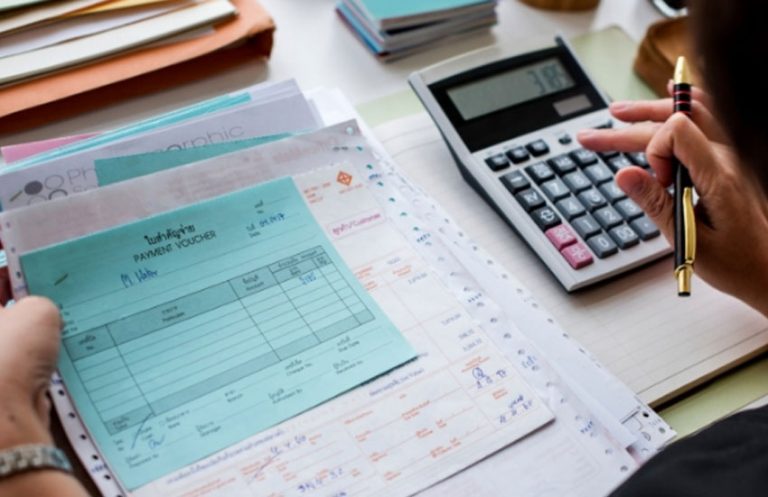

Expert Tax Preparation, Bookkeeping, Payroll & Financial Planning in Minneapolis & Twin Cities

Professional, local tax & accounting experts dedicated to accuracy, reliability, and confidentiality. Serving Minneapolis, the Twin Cities, and surrounding Minnesota communities.

Learn More About Our ServicesCall for Consultation: 612-402-0836

Translation

Personal Income Tax Filing

The largest project most tax payers have to complete each year is their personal income tax returns. They agonize over the record keeping, tax planning, completing and submitting the forms.

We seek to make all of this easier for our clients. As professional tax service, we remove the burden of preparing, reviewing, and submitting the forms. Whether you have a basic situation or a complex one, we have the expertise to assist you.

Business Start Up

Financial Planning

Personal Tax Services

The largest project most tax payers have to complete each year is their personal income tax returns, tax planning, completing and submitting the forms.

Our experienced tax professionals know the perils and pitfalls of working with tax agencies, thoroughly understand your rights, and and regulations.

An Individual Taxpayer Identification Number (ITIN) is a United States tax processing number issued by the Internal Revenue Service for those who need to file.

Corporate Tax Services

We have been helping our clients with highly professional payroll services in the twin cities for over 10 years, we pride ourselves on our payroll services

Hiring Integrity 1st Tax means having a bookkeeper record every financial transaction, even the minutest ones, which your business incurs.

We have the essential tools you need to track expenses, monitor cash flow, and identify financial trends so you can plan for the future of your business

We'll examine how we can best resolve your tax situation.

Get started with a Consultation with

a Integrity 1st Tax professional or

Call (612) 402-0836

Professional Tax Service in Minnesota

We remove the burden of tax preparation and submitting tax forms, so you have more time for the things important to you.

The most common forms we file are:

Form 1040 – Individual Income Tax Return

Schedule A – Itemized Deductions

Schedule B – Interest and Dividend Income

Schedule C – Profit or Loss from Business

Schedule D – Capital Gains and Losses with associated Forms 8949

Schedule E – Supplemental Income and Losses

Schedule F – Profit or Loss from Farming

Plus dozens of other forms and schedules